US Government May Settle 5,000 BTC More From Seized Crypto Assets

This week, the crypto community has been buzzing with talk about the US government’s massive holdings of digital assets. After former President Trump signed an executive order establishing the Strategic Bitcoin Reserve, the administration released details on holding other crypto assets besides bitcoin. The move has sparked controversy over the liquidation of high-value digital assets, which could net thousands of additional BTC for the national treasury.

.jpeg)

US Government May Settle 5,000 BTC More From Seized Crypto Assets

US Government Holds Billions of Dollars in Digital Assets

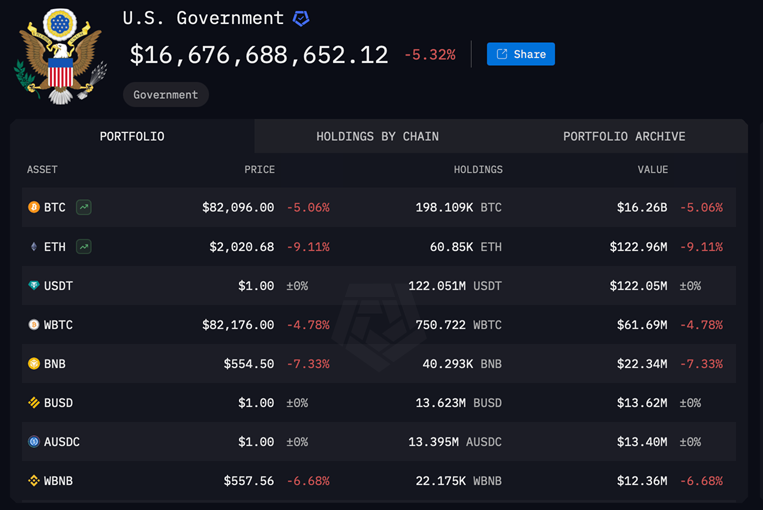

According to reports from Arkham Intelligence, the US government holds a large amount of cryptocurrencies including Ethereum (ETH), Binance Coin (BNB), and stablecoins like USDT and USDC. The total value of the seized and retained assets is in the billions of dollars. In addition to Bitcoin, there are a significant number of other crypto assets that could be liquidated or reallocated.

Reports show that the US government currently holds around 198,000 BTC, worth over $16 billion at current exchange rates. In addition, they own over 60,850 ETH, 40,293 BNB, and many other stablecoins. The government could decide to liquidate these assets to convert to BTC or use them for national budget management purposes.

The government could recover over 5,000 BTC

According to on-chain data, if the government decides to liquidate all of its non-BTC digital assets, including Ethereum, Binance Coin, and stablecoins, the total amount of BTC that could be recovered would be around 5,000 BTC. In particular, selling 60,850 ETH could yield around 1,522 BTC, while stablecoins such as USDT and USDC could also yield a significant return on conversion.

The government is also holding Wrapped Bitcoin (WBTC), a tokenized form of bitcoin on the Ethereum blockchain. The amount of WBTC the government is holding can now be converted into native BTC to increase its Bitcoin reserves.

Managing the government’s cryptocurrency portfolio

Reallocating crypto assets to Bitcoin has been proposed as a solution to better manage the portfolio. The government can decide to retain a portion of its digital assets or liquidate them entirely to increase the amount of Bitcoin it holds. This not only brings financial benefits but also helps the government better manage its high-value digital assets.

The liquidation of seized crypto assets is attracting much attention in the crypto community, especially as the market experiences major volatility. The question is whether the government will decide to liquidate these assets, and if so, what impact it will have on the global crypto market.