Trump Announces 104% Tariffs on Chinese Imports, Global Markets React Cautiously

Trade tensions between the United States and China escalated on Tuesday afternoon after former President Donald Trump announced a "record" 104% tariff on Chinese imports. The move immediately caused a chaotic reaction in global financial markets, wiping out the rally in the US stock market and dragging down cryptocurrencies.

Markets Stumble Amid Policy Wave

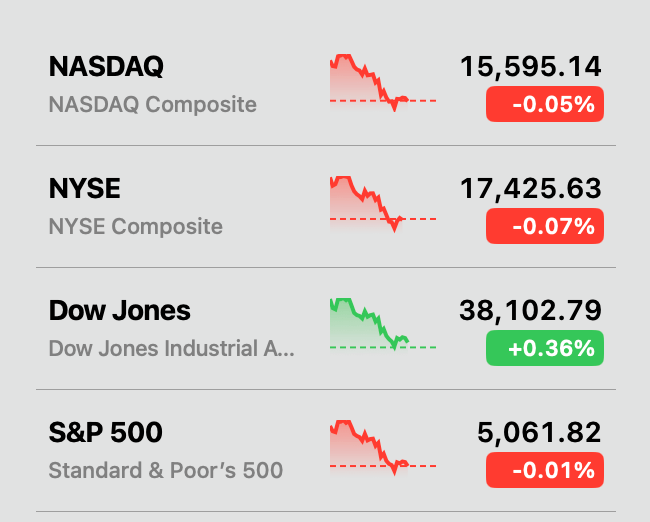

At the start of Tuesday's trading session, major indexes such as the Dow Jones, Nasdaq and S&P 500 all opened in the green, reflecting optimism after a series of positive corporate earnings reports. However, by around 2 p.m. (ET), the indexes reversed course after the White House confirmed that the 104% tariff would officially take effect at midnight if there is no legal intervention.

Meanwhile, the cryptocurrency market recorded an average decline of 2.5% over the past 24 hours. Bitcoin (BTC) fell to $76,500 at one point before rebounding above $77,000. The total market capitalization of digital currencies is currently around $2.43 trillion. Gold – a safe-haven asset – was not spared from the volatility, trading at $2,981/ounce, below the $3,000 threshold.

China responds: "No concessions"

In response to Mr. Trump's statement, the Chinese government quickly warned of the possibility of imposing retaliatory tariffs of 34% and criticized the US for "trade blackmail". According to an editorial from the New York Times, President Xi Jinping affirmed that China "will fight to the end" and has no plans to retreat from the confrontation.

China's Ministry of Commerce also issued a strong statement, accusing the US of violating global trade rules and threatening to sue the World Trade Organization (WTO).

Trump: "We're waiting for their call"

On the Truth Social platform, Mr. Trump wrote that he had just had a "great call" with the acting president of South Korea, adding that the Chinese side "would love to make a deal but don't know where to start."

"We're waiting for their call. It's going to happen," Trump wrote, implying that the game is now in Beijing's hands.

Experts warn of impact on inflation and monetary policy

Reacting to the statement, the president of the Chicago branch of the Federal Reserve, Austan Goolsbee, said the tariffs were "beyond expectations" and could trigger a new wave of inflation if left unchecked. “We’ve just gone through a tough period of inflation, and that’s clearly not going to happen again,” Goolsbee warned in an interview with Illinois Public Radio.

On the prediction platform Polymarket, the odds of an emergency Fed rate cut jumped 3 percentage points in the hours after the announcement.

Uncertain future

With the 104% tariff decision looming and no sign of reconciliation from either side, financial markets could face wild swings in the coming days. Investors are waiting to see whether this is a strategic move by Trump to pressure China during negotiations, or the start of a new, full-blown trade war.

Meanwhile, all eyes are on Beijing – will it give in, retaliate, or wait for another call?