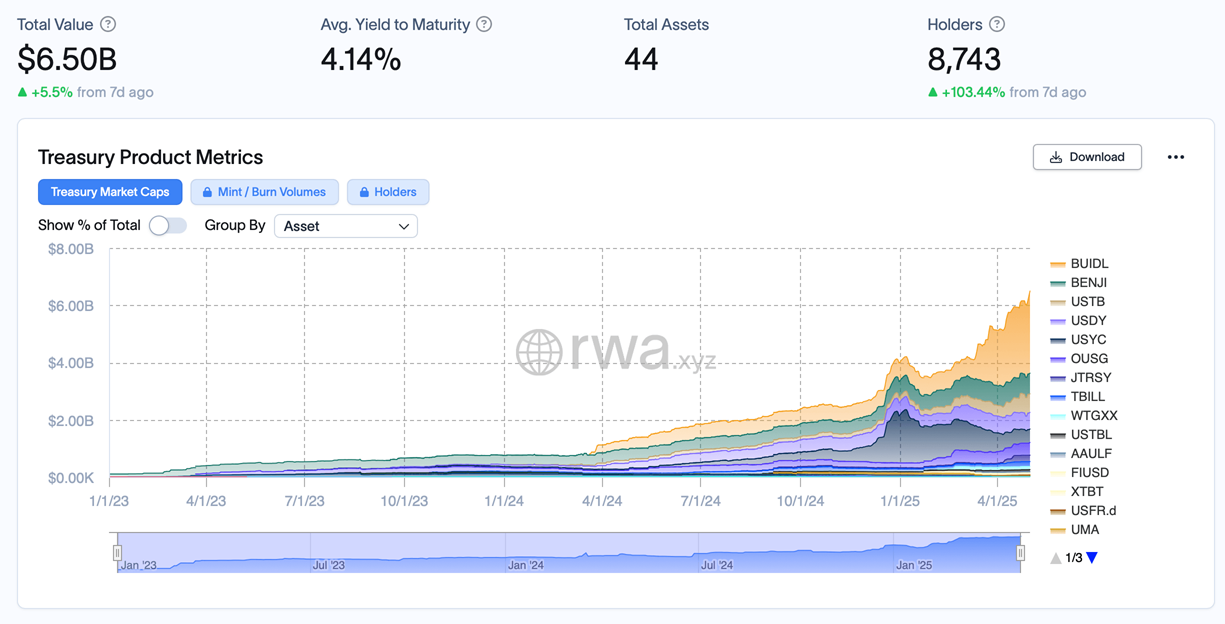

Tokenized Treasury Market Surges by $560 Million in 15 Days, Reaching $6.5 Billion

The on-chain real assets (RWA) market continues to explode as the total capitalization of tokenized treasuries increased by $560 million in just 15 days, bringing the total market value to an impressive $6.5 billion as of May 2, according to data from Rwa.xyz.

This spectacular growth was mainly driven by two prominent names, BlackRock's BUIDL and Superstate's USTB, as these two funds accounted for 98% of the total industry growth.

BUIDL and USTB: Two New Pillars of RWA

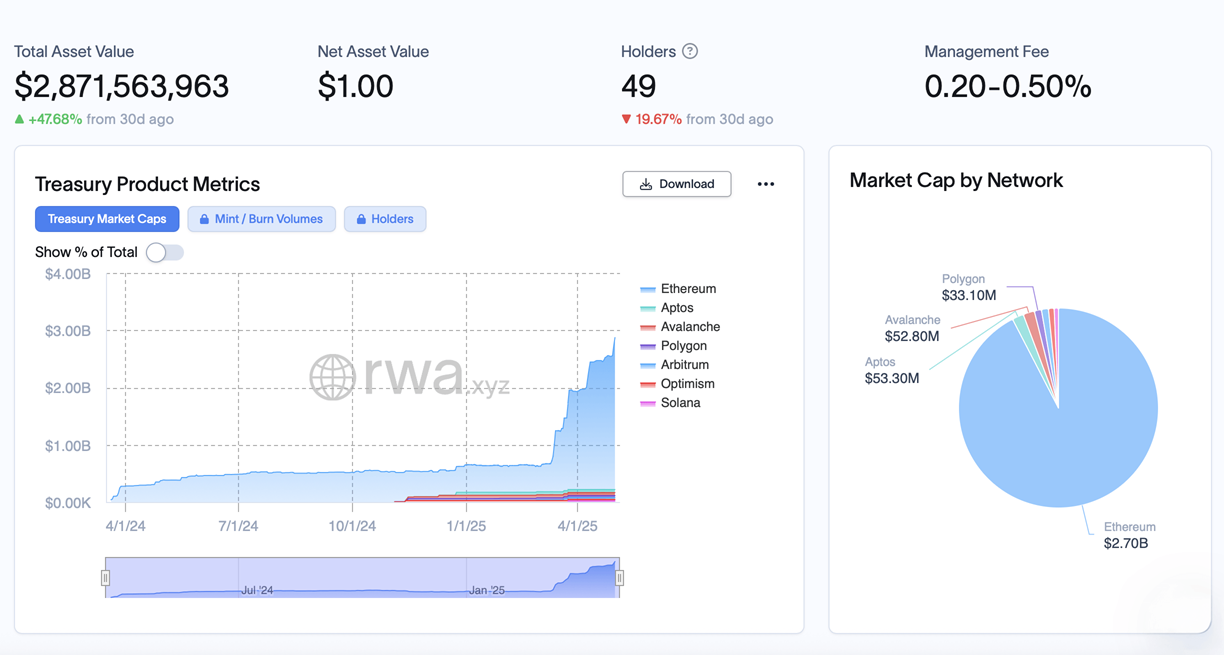

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL), issued through the Securitize platform, saw its market capitalization increase sharply from $2.469 billion to $2.871 billion – equivalent to $402 million. Of which, more than $2.7 billion was issued directly on the Ethereum blockchain.

Meanwhile, USTB – the Superstate’s short-term government bond fund – also grew strongly, from $502.3 million to $651.51 million, surpassing Ondo’s USDY to take the third spot in terms of market capitalization.

A Shift in the Top 5

Ondo’s USDY, which has long held the third spot, fell slightly by $4.7 million to $581.2 million, pushing the fund to fourth place.

Circle’s USYC retained its position in the top five with $468.68 million, down slightly from $525.17 million previously.

BENJI – Franklin Templeton’s Onchain US Government Monetary Fund – also saw a slight increase from $702 million to $716.84 million.

The Gain Is Not Just in Value, But in Number of Investors

According to data from Rwa.xyz, the number of wallets holding crypto-treasury assets has increased by more than 103%, reaching a total of 8,743, reflecting growing interest from both individual and institutional investors. The average yield to maturity across the 44 tokenized bond offerings is around 4.14% – attractive given the high global interest rates.

Quick Take:

The tokenized treasury market is showing potential to become a major pillar in the digital asset space, especially as more major financial institutions like BlackRock and Franklin Templeton enter the space. At its current growth rate, a $10 billion market cap may be just a matter of time.