Tokenized Treasury Bonds Hit $4.77 Billion as Blackrock’s BUIDL Raises $463 Million in Just 8 Days

Recent reports indicate that Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL) has increased by $463 million in an eight-day period. Since the first week of March, tokenized US Treasury funds have seen a $720 million increase, marking a significant jump in the financial growth of these assets.

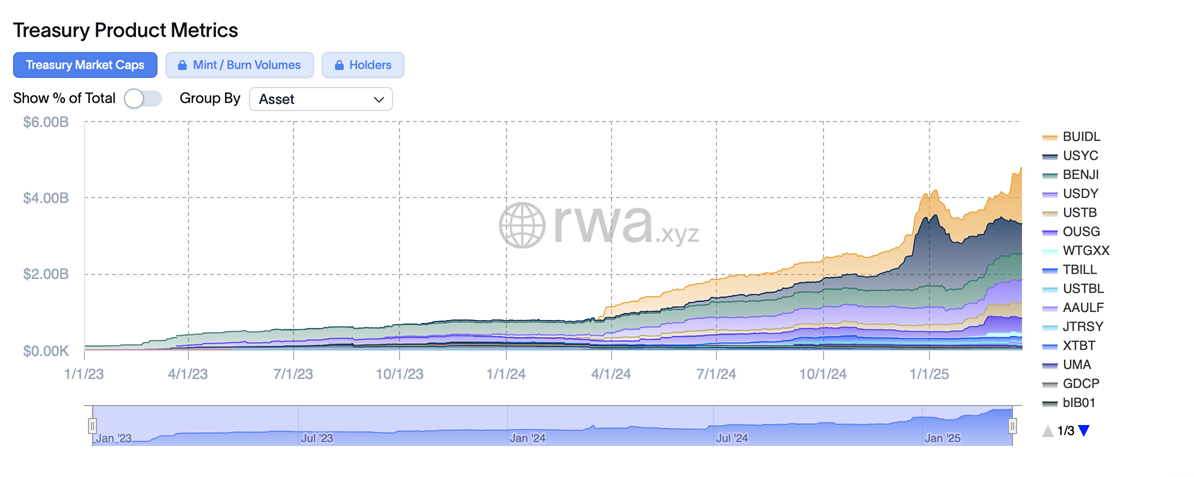

Treasury Bonds — 566% Growth in Just 12 Months

Over the past 12 months, tokenized treasury funds have become a major player in the financial markets, recording an impressive 566% growth. By March 2024, the market value of these digitized treasury bonds was around $716 million, and to date, that number has skyrocketed to $4.77 billion. Notably, since March 4, 2025, the sector has recorded an increase of $720 million, demonstrating rapid growth.

Blackrock’s BUIDL Plays a Key Role in the Expansion of Tokenized Treasury Bonds

Much of the recent growth has been attributed to Blackrock’s BUIDL fund, issued by Securitize, which has become a key pillar in this trend of asset digitization. On March 14, Bitcoin.com News reported that BUIDL had surpassed the $1 billion mark, with total assets under management (AUM) at $1.004 billion. By March 22, the fund’s value had risen to $1.467 billion, reflecting an impressive $463 million increase in just eight days.

Other Treasury Bond Funds Continue to Grow Strong

Meanwhile, Hashnote’s Short Duration Yield Coin (USYC) fund, which had hit $868 million in AUM eight days ago, has dropped $84 million and now has an AUM of $784 million. In contrast, Franklin Templeton’s Onchain U.S. Government Monetary Fund remained stable, with no significant changes since the last report on March 14.

In addition, Ondo’s U.S. Dollar Yield (USDY) and Superstate’s Short-Term U.S. Government Securities Fund (USTB) also recorded growth in March. Specifically, Ondo’s fund increased from $563 million to $593 million, and Superstate’s USTB increased from $310 million to $393 million.

The convenience of payment and redemption processes through blockchain technology has attracted increasing capital flows into digital treasury funds, and this trend shows no signs of slowing down.