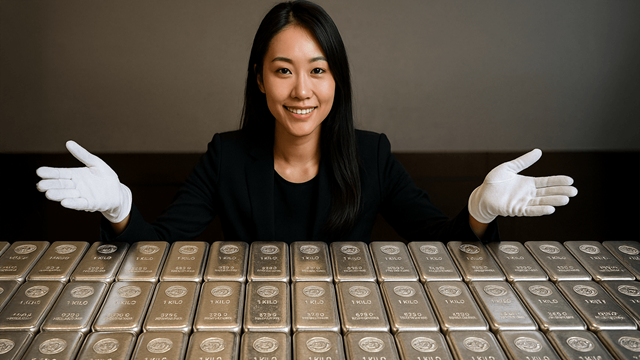

Silver price exceeded 38 USD/ounce: The return of history after 14 years of waiting

While gold almost passed over the past month with a slight decrease of 0.07%, the precious metal market witnessed a vibrant wave from metal silver that was once considered "forgotten" in the investment list. With an increase of 4.89% in the past 30 days, the price of silver has now returned to the $ 38/ounce milestone, marking the first time this threshold since the legendary price increase in 2011.

From the bottom of 14 USD to the $ 38 milestone: Silver back to the game

Since the beginning of the year, silver has increased by 32% compared to the dollar a superior performance compared to many traditional and gold assets. Many analysts believe that this is only the beginning of a new growth cycle of silver. Some expects that the price can reach 50 USD, even 100 USD/ounce in the medium term.

According to Michael Oliver, the founder of MSA Research, the current breakthrough of silver is not merely reacting to investment needs, but the result of this metal has been "suppressed" for a long time:

"Silver has been restrained by the forces on the market for many years. But now that liberation is creating a large -scale semi -position tightening where the short sellers are trapped and forced to play a panic position."

Sights from the market: Silver at the right time

Philip Streible, a market strategist at Blue Line Futures, also agreed with the point of view. He said that the precious metal market is witnessing a significant "capital rotation": when gold maintained over 3,300 USD, platinum recovered strongly, the cash flow began to turn to the metal silver still larger.

"Silver has been out of attention for too long. With a solid technical background and investment demand, this is the time to step on the stage."

Motivation behind: inflation, financial instability and the dispersion of cash flow

Analysts believe that some macroeconomic factors are creating ideal conditions for the gain of silver:

Prolonged inflation and the worry of purchasing impairment caused investors to search for property shelters.

The uncertainty in the monetary and securities market, especially amidst the geopolitical tensions, increases the demand for precious metals.

The cash flow from the cryptocurrency market, is said to be "returning" to traditional physical assets such as silver.

A prominent figure among precious metal investors, Peter Schiff, also said that the current Bitcoin fever is just a "temporary distraction". He affirmed that silver was really notable property right now:

"If you follow my advice from yesterday selling Bitcoin, buying silver now you have higher profits, with a much lower risk."

Milestically 38 USD: Historical significance and prospects ahead

Silver price is currently fluctuating around 38 USD/ounce, the highest level since April 2011 at the peak of the previous increase cycle, when silver has exceeded 47 USD/ounce. Earlier, the last time silver culmated was in 1980 at over 35 USD, in the context of global inflation escalated and geopolitical instability.

Looking forward, many investors and market experts believe that the $ 50 milestone is no longer a special distant thing if the global economic situation continues to maintain the current support factors. Some technical analysis also show that the next resistance area may be 42 - 45 USD, opening up the potential further if it exceeds strong psychological threshold.

Conclusion: Silver is no longer "forgotten metal"

After more than a decade of silence, silver is returning strongly as one of the most attractive investment assets in 2025. With a powerful technical platform, support from big investors, and the supporting macro background, this metal is on the journey to rewrite history not only a place to store valuable, but also a strategic channel for long -term categories.

Although nothing guarantees a price increase cycle forever, but with the present momentum, silver deserves to be closer to investors more closely than ever.