Money Printing — China’s New Economic Policy Could Drive Bitcoin Higher

China is implementing its first large-scale monetary easing in more than a decade, in response to economic pressure and trade tensions with the United States, especially under the Trump administration.

Money Printing — China’s Economic Policy Could Drive Bitcoin Higher

China Adjusts Monetary Policy to Counter Trump’s Tariff Impact

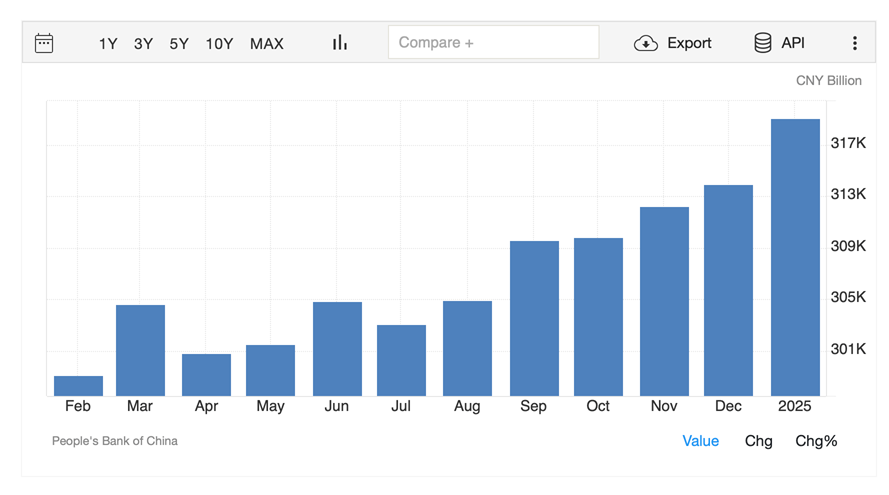

In December 2024, the Chinese Politburo officially announced a shift in monetary policy from “prudent” to “moderately loose” for 2025, aimed at boosting economic growth. This will focus primarily on expanding domestic demand and encouraging consumption. According to data from January 2025, China's M2 money supply has increased significantly from 313.61 trillion yuan ($42.9 trillion) in December 2024 to 318.46 trillion yuan ($43.6 trillion).

Money Printing — China's Economic Policies That Could Drive Bitcoin Prices Higher

China's M2 Money Supply

The People's Bank of China (PBOC) has used a variety of monetary policy tools to maintain liquidity, including cutting reserve requirement ratios (RRRs) and adjusting interest rates downward. These policies are designed to stimulate the economy amid domestic deflation. China has experienced two consecutive years of deflation, a rare situation in economic history, paralleling Japan's challenges in previous decades.

Money Printing — China’s Economic Policies Could Push Bitcoin Higher

While China’s focus is on stabilizing its domestic economy, pressure from trade tensions with the US, especially the tariffs Trump may reimpose, is also a major driver. The Politburo has publicly acknowledged preparing for these trade wars, with monetary easing seen as a defensive measure to mitigate the impact from the US economy.

Money Printing — China’s Economic Policies Could Push Bitcoin Higher

China’s monetary base (M0) is forecast to increase by about 17.2% by 2025, equivalent to about 2.21 trillion yuan ($303 billion), while the M2 money supply could increase by about 7%, adding 22.17 trillion yuan ($3.04 trillion). This highlights China’s proactive strategy of using monetary tools to achieve economic goals.

Many observers believe that China’s move could trigger a similar response from other central banks, leading to a global liquidity surge. Historically, money supply expansion has often been a boon for asset prices, especially alternative financial assets like Bitcoin.

Cryptocurrencies and Bitcoin benefit from global monetary expansion

Cryptocurrencies, especially Bitcoin, have often responded positively in situations involving global monetary easing. Investors view Bitcoin as a hedge against potential inflation caused by excessive money printing, and speculators believe that China’s policies could push Bitcoin prices higher. This sentiment has been evident in previous economic stimulus packages, such as during the pandemic, when central banks ramped up liquidity.

China’s aggressive monetary policy shift, combined with the effects of global central banks, highlights Bitcoin’s role as a currency alternative. The risk of inflation and currency devaluation often associated with large-scale monetary easing will continue to increase Bitcoin’s appeal as a store of value.

With China’s aggressive money printing drive and Trump’s tariff threats, global investors are closely watching market developments. If other central banks follow China’s lead, the new wave of liquidity could push Bitcoin and other cryptocurrencies higher, making them big beneficiaries of volatile global currencies.