Hashprice Plunges Below $40: Red Alert for Bitcoin Mining Amid Tariff Pressure and Rising Costs

.jpeg)

The Bitcoin mining industry is facing its biggest challenge since 2023 as the hashprice – a measure of miners’ profitability – officially fell below $40/PetaHash/second, according to a new report from TheMinerMag.com. This is a near-breakeven profit level for even the largest listed mining companies, threatening to push many small-scale miners out of the market.

Rock-bottom Profit Margins, Weighing on Electricity Costs

Wolfie Zhao, head of research at TheMinerMag, said that two consecutive difficulty hikes in March (up 1.43%) and April (up 6.81%) have caused the cost of operating the mining fleet to skyrocket. Meanwhile, transaction fee revenue continues to decline, now contributing only about 1.2% of the total block reward.

Zhao estimates that the average hashing cost has risen to nearly $34 per PH/s for public miners, pushing the hashprice into the danger zone. “When the hash price drops below $40, the mining industry enters a period of purification,” he warns.

Impact of tariffs and geopolitical uncertainty

In addition to domestic market pressure, new tariff proposals from former President Donald Trump are also adding to the uncertainty of the mining industry. According to Zhao, the new tariff plans could severely impact the supply chain of ASIC equipment – the core element of Bitcoin mining – especially for companies that rely on hardware manufactured in China.

This uncertainty has made many investors nervous. The MinerMag’s Price-to-Hashrate ratio has dropped to $50/TH/s – its lowest level since the US presidential election, dragging the industry’s total market capitalization below $20 billion.

Big players struggle, but sell-offs intensify

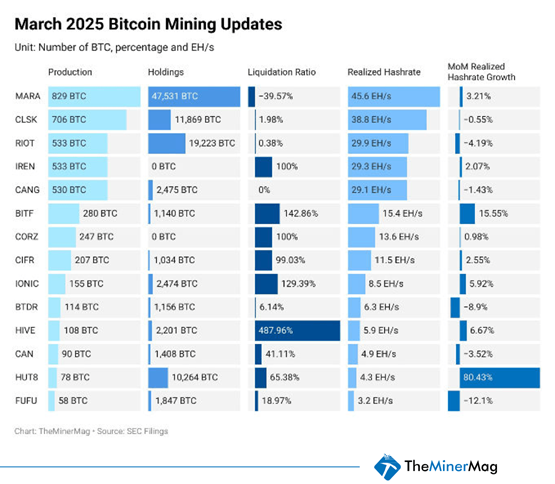

While the majority of the market has been struggling, some companies like Bitfarms and Hut 8 have grown their hashrate by 16% and 80% respectively over the past month. Marathon Digital (MARA) is still leading the pack with over 40 EH/s. However, this does not reflect overall stability as many listed companies were forced to sell up to 42% of their mining output in March – the highest level since October last year.

These moves mark a shift from a “HODL” (long-term coin holding) strategy to asset sales to maintain liquidity and cover operating costs.

Is a capitulation wave coming?

Zhao commented: "If the hash price does not recover in the short term, a wave of small miners will be forced to leave the market." He believes that only high-efficiency miners with cheap electricity contracts and solid financial strategies can survive this difficult period.

The Bitcoin mining industry is entering a new testing phase - where efficiency, scale and adaptation strategies become vital factors. If the hash price continues to weaken, the market could see a deep restructuring in the coming months.