Gold prices plummet as US-China trade war halts; Bitcoin remains strong

.jpeg)

Amid cooling trade tensions between the US and China, global financial markets have reacted strongly. Gold prices – considered a safe-haven asset – have plummeted by more than $100/ounce, while Bitcoin has maintained remarkable stability, continuing to trade above $104,000.

Gold “slips” as markets breathe a sigh of relief

From the beginning of the trading session on May 12, gold prices showed signs of weakness as reports showed that the US and China had reached an agreement to reduce tariffs. According to data from international exchanges, the precious metal plunged from $3,323 to below $3,215/ounce – a decrease of nearly 3%.

The decline in gold reflects a drop in demand for traditional safe-haven assets as geopolitical and trade risks temporarily ease. Investors tend to withdraw capital from gold and move to riskier assets during periods of market stability.

Bitcoin: “Digital Gold” Resilient Against Volatility

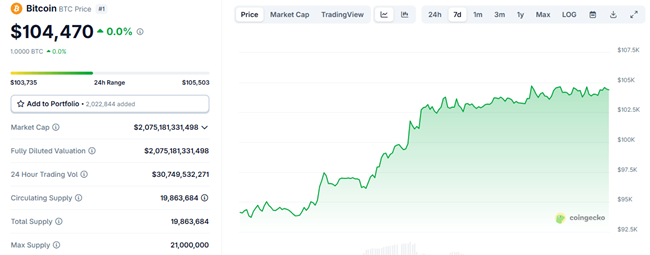

In contrast to gold, Bitcoin – often referred to as “digital gold” – continues to demonstrate its resilience to political and economic volatility. As of mid-day on May 12, Bitcoin remained above $104,000, maintaining a stable state since surpassing the psychological $100,000 mark earlier this month.

Analysts say Bitcoin’s stability amid the turmoil in traditional assets is a sign that cryptocurrencies are increasingly recognized as an independent store of value. Since mid-April, Bitcoin has shown a tendency to decouple from the movements of traditional financial markets, especially when the trade war shows no signs of cooling down.

90-day agreement gives a boost to global markets

According to a statement from US Treasury Secretary Scott Bessent, the world's two largest economies have reached an agreement to temporarily halt the escalation of trade tensions for 90 days. The US agreed to reduce import tariffs on Chinese goods to 30%, while China will reduce import tariffs on US goods to 10%.

The agreement also includes the establishment of a bilateral economic and trade dialogue mechanism, a move that is expected to open a more sustainable negotiation phase in the future.

Analysts' reactions are mixed

Peter Schiff, a longtime gold advocate and prominent Bitcoin critic, said that this agreement is only "temporary" and has no long-term significance. “This deal simply postpones the war for 90 days without any significant concessions from China,” he said.

However, global stock markets have responded positively. Hong Kong’s Hang Seng Index rose more than 3% on the day, while European bourses were all in the green. US markets are also expected to open in the green, up more than 2% according to futures.

Gold and Bitcoin Futures: Reversal or Complement?

Despite the downward pressure on gold, many experts believe that the precious metal still plays an important role in long-term investment portfolios. Meanwhile, Bitcoin is increasingly asserting its position as an independent alternative asset, especially in the era of financial digitization.

The divergence between gold and Bitcoin in the trading session on May 12 not only reflects short-term market sentiment, but also suggests a new trend in the way investors view and value assets that protect value in the future.