Fibonacci Retracement: A Compass for Bitcoin Trading Strategies

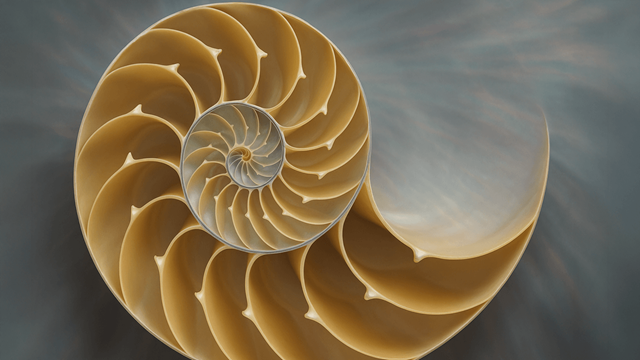

In the quest for profit in the volatile world of cryptocurrencies, identifying key price zones is key to making accurate trading decisions. One of the most prominent and trusted technical tools today is Fibonacci Retracement – a perfect combination of classical mathematics and modern market analysis.

From Ancient Numbers to Modern Charts

Fibonacci Retracements are based on the famous number sequence introduced by Italian mathematician Leonardo Fibonacci in the 13th century. This sequence, with each number being the sum of the two preceding numbers, creates “magical” ratios such as 23.6%, 38.2%, 50%, 61.8%, and 78.6% – numbers that not only appear in nature but are also used by traders to identify potential support and resistance areas in financial markets, especially Bitcoin.

When prices move in a trend (up or down), they often make temporary corrections before continuing. Fibonacci Retracements help identify potential corrections, from which traders can find appropriate entry and exit points.

Bitcoin Chart Application

Let’s say Bitcoin rallies sharply from $80,000 to $100,000, and then begins to correct. Using the Fibonacci tool from bottom to top allows to identify areas such as 38.2% ($93,640), 50% ($90,000), and 61.8% ($87,640) as possible temporary support levels. If the price bounces from one of these levels, the uptrend could be reinforced. Conversely, if the price breaks through, deeper levels such as 78.6% or even the base level could be tested.

The Power of the 61.8% “Golden Ratio”

Of the Fibonacci levels, 61.8% is considered the most important – not only because of its mathematical origin, but also because of market psychology. This is the level at which many traders place their hopes for a reversal, creating a self-reinforcing effect. When this level coincides with other technical factors such as trend lines, 200-day moving averages, or supply and demand zones, it becomes a valuable confluence area in a trading strategy.

Combining Fibonacci with Other Supporting Tools

Fibonacci Retracements are most effective when used in conjunction with technical indicators such as RSI, MACD, volume, or candlestick patterns. For example, if Bitcoin corrects to the 38.2% level and a bullish engulfing candlestick pattern appears with RSI in oversold territory, this could confirm a potential buy signal.

Combining multiple indicators increases the probability of accuracy while minimizing the risk of noise signals.

Distinguishing Retracements from Reversals

Not every price decline signals a trend reversal. Retracements are just short-term corrections in the main trend, while reversals are complete changes in direction. Fibonacci helps to define the boundary between the two concepts.

For example, if the price holds at a 50% retracement level with increasing volume and continues to move up, it could be a healthy retracement. Conversely, if key levels are broken with strong downward momentum, it could be a sign that a new trend is forming.

Forecasting Trends with Fibonacci Extensions

In addition to identifying retracement points, Fibonacci Extensions help estimate price targets as the trend continues. For example, after the rally from $90,000 to $100,000, if Bitcoin corrects to $95,000 and then continues to move up, the 161.8% Extension level could be a target price zone around $106,180. This helps traders plan their exits and manage their positions more effectively.

Limitations to Note

Fibonacci is not a magic tool. The choice of high and low points to draw retracement levels is subjective, and in a sideways market, these levels can be invalid or misleading. Therefore, market context and confirmation from other tools are key to using Fibonacci wisely.

Discipline in a Chaotic Market

The Bitcoin market is notorious for its extreme volatility. In such an environment, Fibonacci Retracements are not only an analytical tool, but also a guide to maintaining trading discipline. From the 4-hour chart to the weekly chart, Fibonacci levels provide a clear framework of structure amidst the chaos – an important anchor for rational decisions.

Conclusion: Think Probabilistically, Not Predictively

Using Fibonacci is not about accurately predicting the future, but rather about identifying high-probability areas where significant price action is likely to occur. When combined with a rigorous trading strategy and careful risk management, Fibonacci becomes a powerful tool that helps Bitcoin traders navigate the market with reason instead of emotion.