Fed Rate Cut Odds Plunge Despite Trump's Pressure

Less than three weeks before the Federal Open Market Committee's (FOMC) key policy meeting on May 7, expectations for a rate cut by the US Federal Reserve (Fed) have fallen sharply, despite repeated criticism from former President Donald Trump.

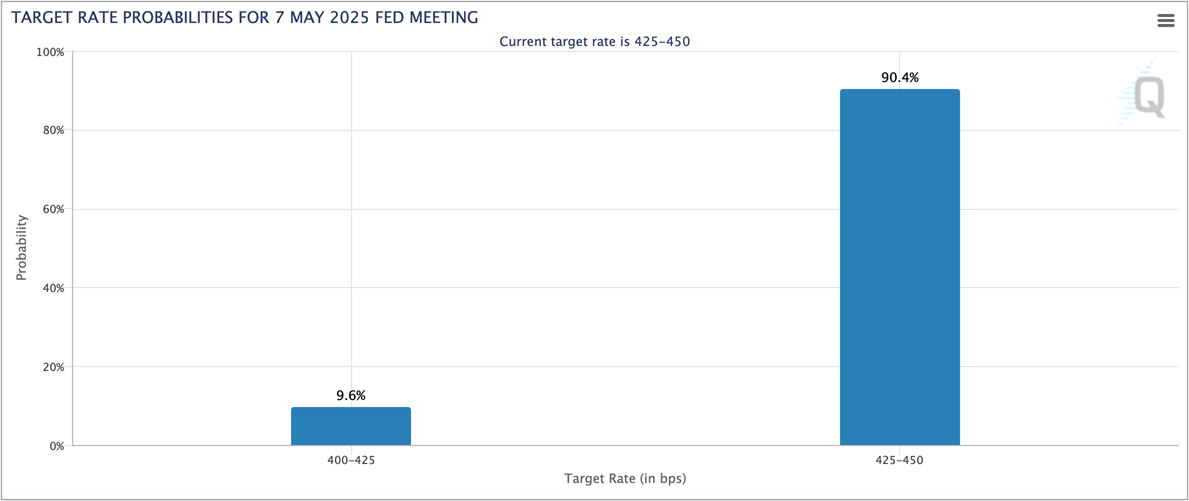

Just five days ago, the probability of a 25 basis point rate cut was estimated at nearly 40%. However, by the afternoon of April 17, that probability had dropped to 9.6%, while the probability of a rate cut now stood at 90.4%.

The drop in expectations comes as Trump continues to publicly criticize Fed Chairman Jerome Powell, accusing him of delaying important policy decisions and failing to act in sync with global central banks amid escalating economic tensions over trade and tariffs.

“Powell needs to cut rates now to make the US economy competitive,” Trump said recently. He even hinted at the possibility of “terminating the contract” with Powell if things don’t change.

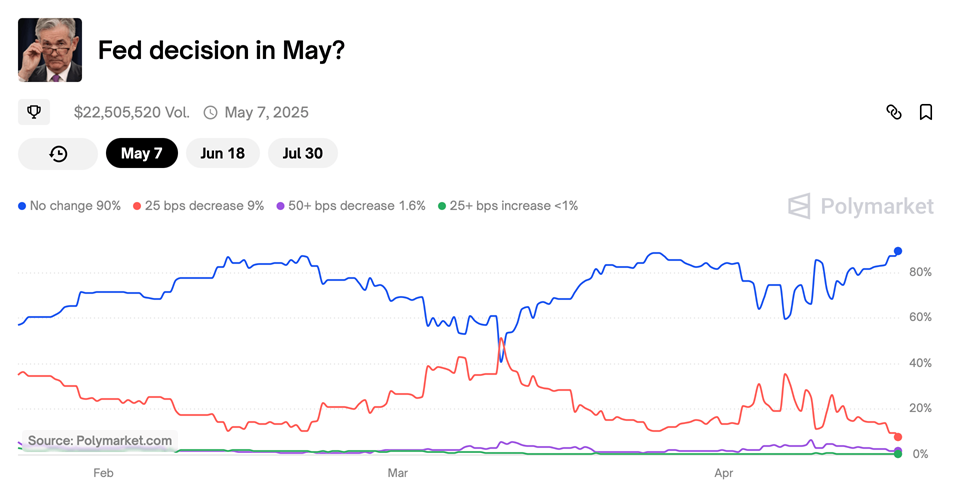

But the market remains firm. Data from prediction platforms like Polymarket and Kalshi show that most investors believe the Fed will not move in May. On Polymarket, 90% of participants predict the Fed will keep rates unchanged, while only 8% expect a cut. Kalshi notes a similar sentiment, with 89% betting on no change, and just 10% predicting a cut.

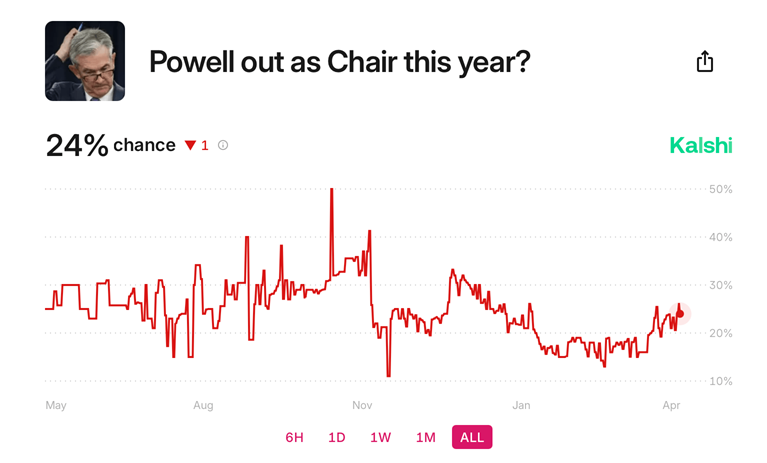

Notably, both markets are tracking the possibility that Trump could fire Powell this year. Polymarket values the possibility at 20%, while Kalshi puts it at a slightly higher 25%.

While the likelihood of a near-term rate cut seems slim, analysts warn that economic pressures are mounting. From geopolitical upheaval to persistent inflation risks to cracks in global supply chains, the Fed could soon face tougher choices than ever.

“Life changes fast,” Powell once said, quoting Ferris Bueller. With Trump in the race for the White House, that pace could accelerate.