Bitcoin Re-Accumulation Catches Attention of Major Investors, Says Cryptoquant

As the political landscape continues to change, major bitcoin (BTC) investors are entering a new phase of re-accumulation, according to a report from Cryptoquant. On-chain data and analysis from researchers show an increasing accumulation trend amid shifting market dynamics.

Bitcoin Re-Accumulation Catches Attention of Major Investors, Says Cryptoquant

Report: Major Investors Drive Market Amid Weak Demand

Cryptoquant's report shows that major investors have significantly increased their bitcoin holdings, with holdings rising 2% since January 17, 2025. This is the largest monthly increase since December 2024. The change is believed to have been influenced by political factors, especially the inauguration of President Donald Trump.

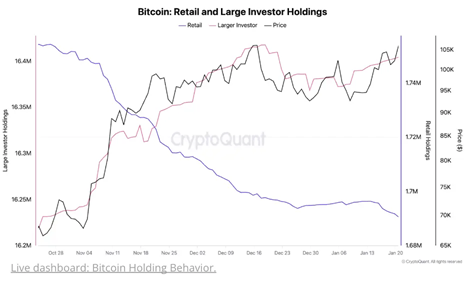

In total, large investors increased their bitcoin holdings from 16.2 million BTC in November to 16.4 million BTC in January. Meanwhile, small investors decreased their holdings from 1.75 million to 1.69 million BTC during the same period. Cryptoquant notes that these large holders have a strong impact on the overall value and demand of bitcoin.

Demand has yet to recover strongly

Although large investors are accumulating more BTC, the overall market demand for bitcoin has not met expectations. The report points out that since December 2024, the growth in demand for bitcoin has slowed significantly. In December, the market recorded an increase in demand of about 279,000 BTC, but by January, this number had dropped to only 75,000 BTC.

Cryptoquant warns that without a strong rebound in bullish momentum, the market will find it difficult to sustain sustained price increases.

Selling Pressure Decreases, Realized Profits Stagnate

Another important factor reported is the apparent decrease in selling pressure in January. In December, when the bitcoin price approached the $100,000 mark, daily realized profits rose to $10 billion. However, by January, this figure had dropped to around $2-3 billion per day. This decline suggests that most profit-taking has subsided, contributing to a reduction in short-term selling pressure.

Ethereum Continues to Fall Behind

Meanwhile, ethereum (ETH) has yet to catch up with bitcoin, with its value falling 43% against BTC since the end of 2023. The main reason for this decline is the sudden increase in ETH supply. The 2022 Merge upgrade was expected to help deflate the ETH supply, but instead the total supply increased from 120.0 million in April 2024 to 120.5 million in January 2025, negating the expected benefits of the upgrade.