Bitcoin Holds $95,000 as Gold ETF Inflows Continue to Flow Into Bitcoin ETFs

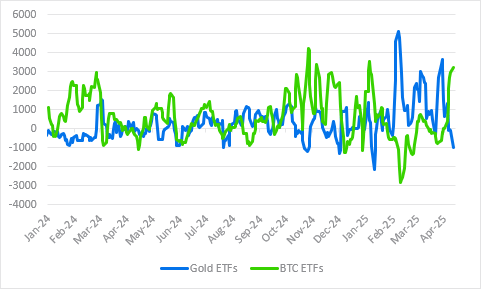

New data from Standard Chartered Bank shows that Bitcoin ETFs are increasingly overtaking gold ETFs, signaling a shift in global investment strategies.

With Bitcoin hovering around $95,000, a new study from Standard Chartered shows a significant shift in investor flows from spot gold ETFs to Bitcoin ETFs. The move is seen as clear evidence of a changing market sentiment, with a new preference for digital assets over traditional precious metals.

In a report published on Tuesday, Geoffrey Kendrick, head of digital asset research at the bank, highlighted that the gap between gold ETF inflows and Bitcoin ETF inflows is widening. “The last time we saw this kind of premium was during the week of the 2024 US Presidential election,” Kendrick said in a note to clients.

He predicts Bitcoin could hit an all-time high of $120,000 this summer, with the potential to hit $200,000 by the end of 2025. “Bitcoin is emerging as a more effective strategic hedge than gold, particularly as international investors seek safe havens from asset reallocation away from the US market,” Kendrick added.

Markets hold steady

According to data from CoinMarketCap, Bitcoin is currently trading at $95,371, up 1.37% over the past 24 hours and up 4.59% over the week. Meanwhile, trading volume fell 19.34% to $24.86 billion, indicating that the market is entering a lull after its recent rally.

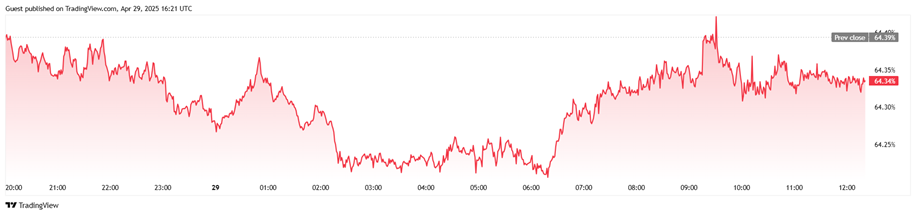

Bitcoin’s market capitalization also increased to $1.88 trillion, although BTC’s dominance in the cryptocurrency market decreased slightly by 0.095% to 64.34%. This shows that while Bitcoin remains the leading asset, altcoins are starting to gain traction again.

Derivatives Markets Are Quiet

Data from the Coinglass platform shows that the derivatives market remains relatively stable. Open interest fell slightly by 1.35% to $62.51 billion. Total liquidations for the day stood at just $73,960, with the majority of liquidations being longs worth $57,740, while shorts were only $16,230. This reflects low volatility and the confidence that remains present in the investment community.

Conclusion

The surge in Bitcoin ETFs not only reflects the demand for digital assets but also signals the diminishing role of gold in strategic hedge portfolios. With steady growth and positive investor sentiment, Bitcoin is likely to continue to maintain its leading position in the coming months.