Bitcoin Hashrate Falls as Miners Face Challenging March

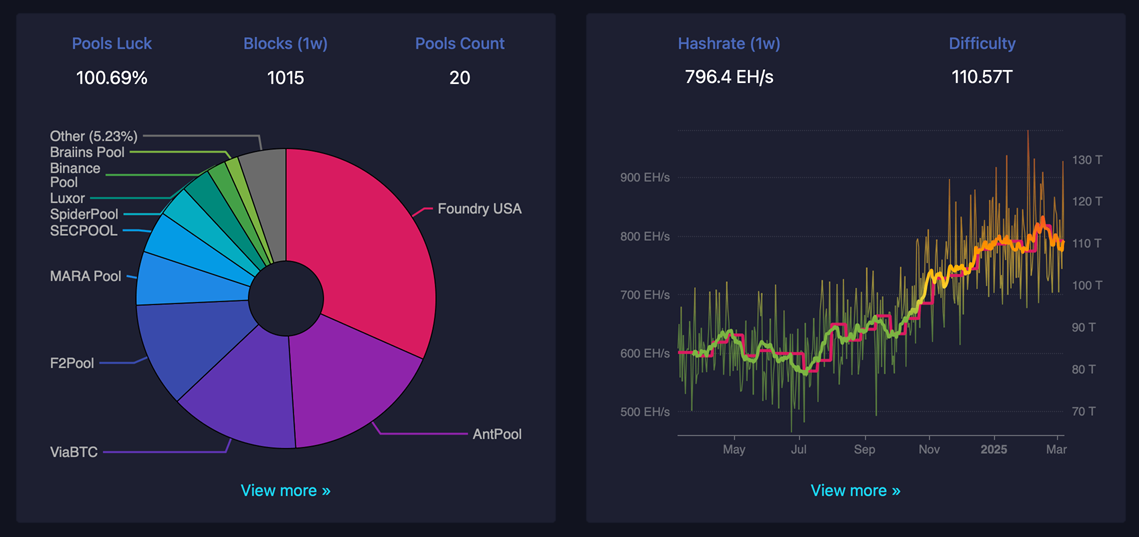

Bitcoin’s hashrate—the estimated revenue generated by 1 petahash per second (PH/s) of mining power—has fallen from $53.13 per petahash to its current level of $49.81 over the past seven days. Over the same period, Bitcoin’s total hashrate has recovered significantly from its February 25 low, adding more than 41 exahashes per second (EH/s), reaching a current rate of around 794 to 796 EH/s.

Bitcoin Hashrate Falls as Miners Prepare for Tough March

Bitcoin miners could face challenges in March as profits decline. In February, miners earned $1.24 billion, down from $1.4 billion in January. In the first week of March alone, miners earned $250.75 million, including $2.97 million in on-chain transaction fees. 30 days ago, Bitcoin’s hash rate stood at $56.73 per PH/s, much higher than the current $49.81.

Profitability likely to decline as difficulty increases

March is expected to be a quiet month if conditions do not change positively. However, there was a bright spot as mining power increased by 5.44%, from a low of 753 EH/s to 794 EH/s. Foundry took the lead with 31.43% of the market share, Antpool contributed 17.44%, and ViaBTC took third place with 13.99%. These three mining pools now control 62.86% of Bitcoin’s total 794 EH/s.

However, the outlook for miners remains bleak as the mining difficulty is expected to increase by 1.29% around March 9. Transaction volumes are moving at a rapid pace, with each block taking an average of 9 minutes and 52 seconds to be processed. Priority transactions are paying an average fee of 3 satoshis per virtual byte (sat/vB), which is about $0.36 per transaction.

Profitability Pressure Forces Miners to Adjust Strategies

With mining pools consolidating control and mining costs rising, the pressure on profitability may force miners to adjust their strategies to stay afloat. The future of Bitcoin mining in the short term depends on balancing the increasing network difficulty with the ability to mine efficiently. Miners are hoping that the market value of Bitcoin will recover to improve profitability and support the industry's growth.